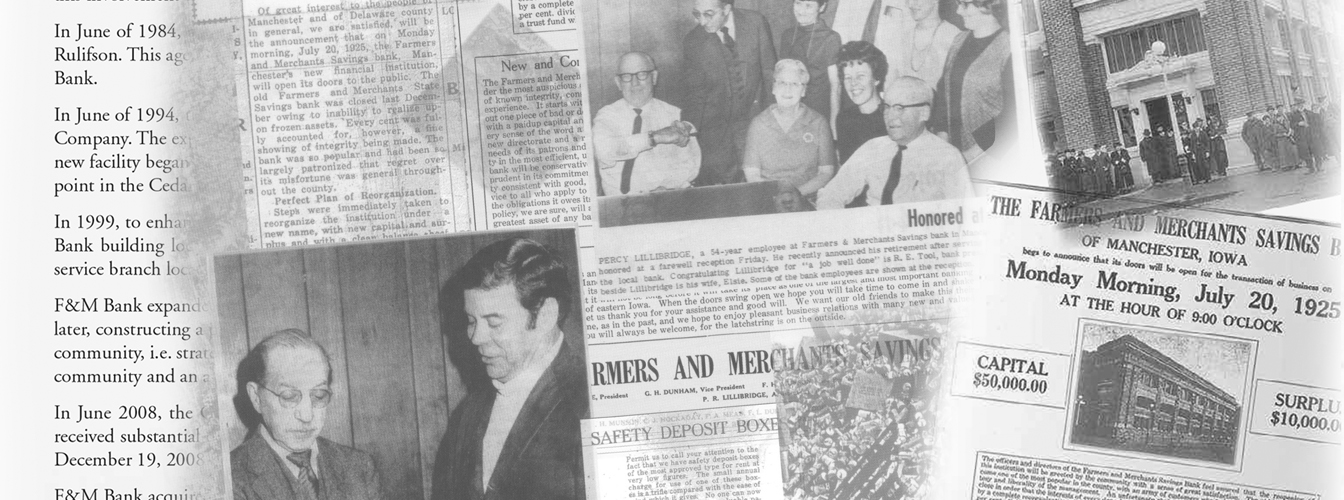

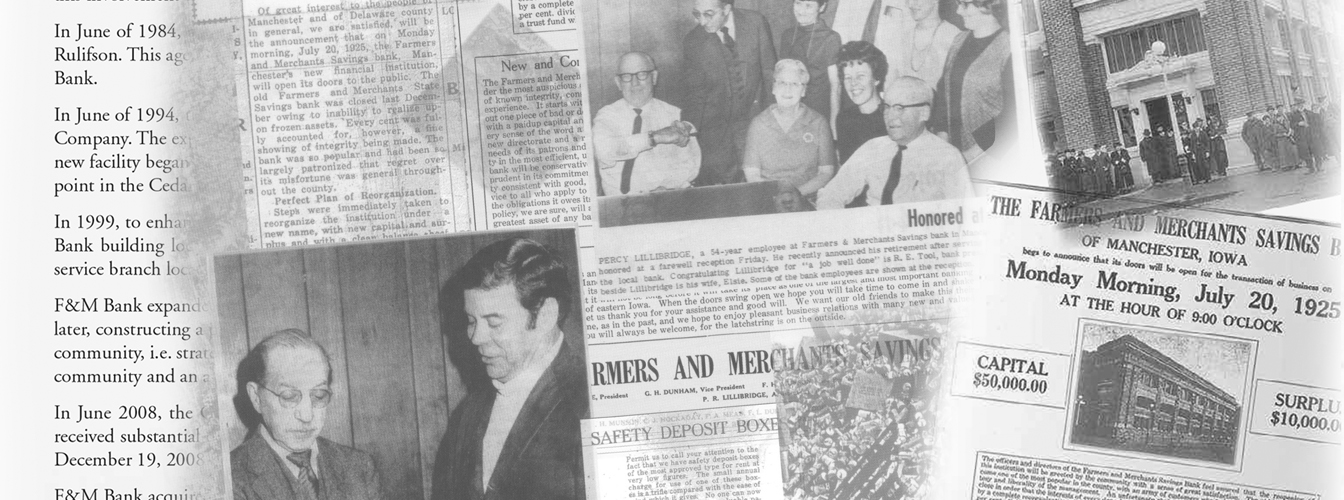

Farmers & Merchants Savings Bank opened for business in Manchester, Iowa on July 20, 1925. J.J. Burbridge headed a group of local investors in reorganizing the Farmers & Merchants State Savings Bank, which had closed in December of 1924 as a result of the agricultural recession. J.J. Burbridge served as the new bank’s President and as of the opening day the bank had amassed assets totaling $299,730.

The Bank grew prudently under the leadership of Mr. Burbridge, surviving the stock market crash of 1929 and the ensuing depression in the 1930’s. Mr. Burbridge was President until his sudden death at the age of 59 in July of 1950. Shortly thereafter, R.E. Tool was named President and remained active in the Bank until his retirement in 1983.

In 1971, F&M Bank - along with First State Bank - sponsored an ecological promotion in connection with Manchester’s Annual Ridiculous Day. The banks agreed to pay one cent for every empty pop can presented that day. Before Ridiculous Day ended, North Franklin Street was blocked off and a fence had to be installed to contain the 135,222 cans that were redeemed.

In January of 1974, F&M Bank opened a Drive-Up facility at 105 East Delaware in Manchester. This new facility not only provided the added convenience of drive-up and walk up services, but also provided extended banking hours. In 1975 the Bank celebrated a major renovation and expansion of its main facility. The project continued for more than two years as the demolition of the former Anthony’s Building had to take place over the top of the existing Bank facility. The expansion tripled the size of the building and added a Community Room to the second level. Today, the facility continues to be modern, well-functioning and very suitable to the operational requirements of F&M Bank.

In November of 1978, R.E. Tool sold controlling interest in the Bank to Cecil W. Dunn and his family. The Dunn family has been involved not only in ownership, but has also taken an active role in the management of the Bank. Today this involvement extends to the third generation of Dunns.

In June of 1994, the Bank purchased the former United Federal Savings Bank in Cedar Rapids from the Resolution Trust Company. The expansion into the Cedar Rapids market proved to be successful. In February of 1998, construction of a new facility began at 4000 First Avenue NE. The new bank building was completed in September 1999 and is a focal point in the Cedar Rapids metropolitan area.

In 1999, to enhance client service and promote opportunities for growth, F&M acquired the former First National Bank building located at Second Avenue & First Street SW, Cedar Rapids. This facility became the second full service branch located in Cedar Rapids on April 29, 2002.

F&M Bank expanded into the Anamosa market in November 2004; beginning in a temporary location, and a year later, constructing a permanent facility in downtown Anamosa. Many factors played a part in branching into this community, i.e. strategically located between Manchester and Cedar Rapids, an established business and industrial community and an area for potential growth.

In June 2008, the Cedar River engulfed the majority of downtown Cedar Rapids. F&M’s First Street facility received substantial damage caused by well over nine feet of flood water. The drive-up was reopened on Friday, December 19, 2008 and offices on the upper level were remodeled and re-occupied in August 2010.

On December 17, 2010, F&M Bank entered into a purchase and assumption agreement with the FDIC to assume all of the deposits of Community National Bank of Lino Lakes and Vadnais Heights in Minnesota. All employees were retained and played an integral part in the smooth transition. This acquisition was the bank’s first expansion outside of Iowa.

F&M Bank added its seventh location in February 2014 in downtown Monticello, Iowa which was formerly occupied by Bank of the West. This addition is the Bank’s second facility in Jones county.

F&M Bank is proud of its rich tradition and is committed to providing the services and products that will continue to make F&M Bank “The Right Choice” for the next 99 years and beyond.

What We’re About:

What is different about F&M from the vast choices of financial institutions?

- WE CARE about our client’s success—our success depends on your success!

- WE CARE about our team—Our Officers and Employees enjoy working at F&M which translates into prompt, personalized service to our clients. Our F&M team has a combined total of 620 years of banking experience.

- WE PRIDE ourselves on local decision making! This is a remarkable advantage and benefit to our clients and the communities we serve.

- WE AIM to grow and remain independent, while still being very responsive to the financial needs of our clients and communities.

Although we are a relatively small community bank, we can meet virtually any banking need. We have the flexibility to customize our products and services to meet the needs of our clients.

F&M Bank is “here for the long haul.” Our approach has always been to grow the bank prudently and to develop relationships that will be of benefit to our clients as well as F&M Bank.

We thank our clients for the confidence and trust in our Bank as well as the referrals they have provided us.

You are invited to visit with our team to discover how F&M Bank can assist you in reaching your financial goals. We are confident you will discover that F&M Bank is... "The Right Choice"

What We Offer:

- Deposit Products: Checking, Savings, Money Market, Certificates of Deposit

- Loan Products: Commercial, Ag and Consumer Loans, Credit Cards

- Services: Online Banking, Bill Pay, E-Statements, Treasury Management, Remote Deposit

- Trust Services: 401(k), Keogh’s, Simplified Employment Pensions,

- Traditional/Roth/Educational IRAs, Health Savings Accounts, Personal Trust Services, Agencies & Conservatorships and Estates